Platform Overview

Paradex is built on top of SuperChain, their proprietary Layer 2 (L2).

- Note: Requires automatic generation of a new Paradex address

- Claims 1,000 TPS and 2-second finality

- Some code is open source

- Uses a hybrid approach: on-chain settlement & custody, off-chain matching & risk management

System Components

Off-chain

- Matching engine

- Risk engine (some components)

On-chain L2 (Private StarkNet)

- Risk engine (some components)

- Trade settlement

- Custody

On-chain L1 (Ethereum)

- On/off ramp

- Custody

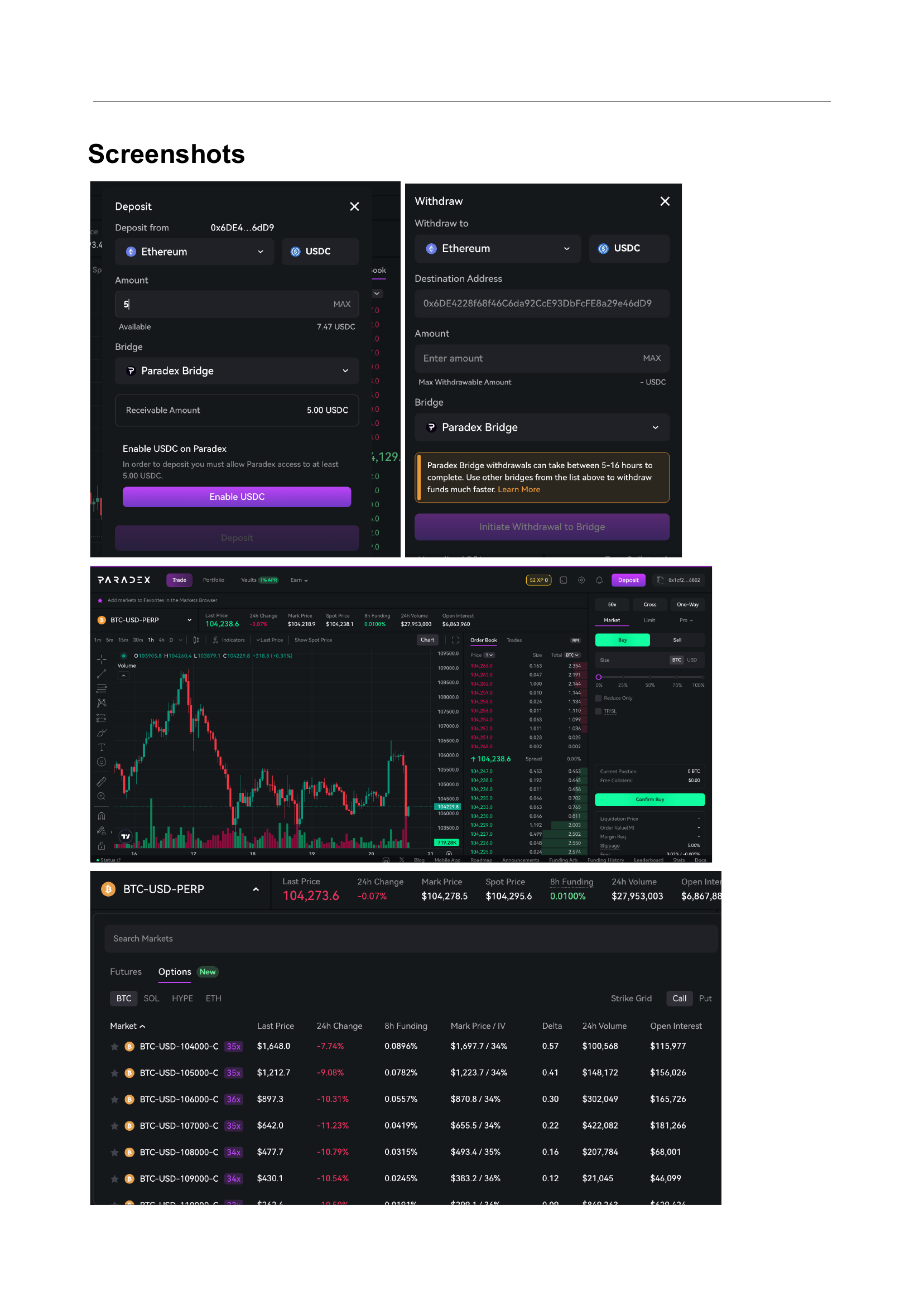

- Note: Bridges are used to get funds into the exchange – see screenshots below

- Various components audited and pen-tested

- Bug bounty program available

Current Products

- Perpetual Swaps

- Perpetual Options

- Note: This type appears to be developed by a Paradigm researcher

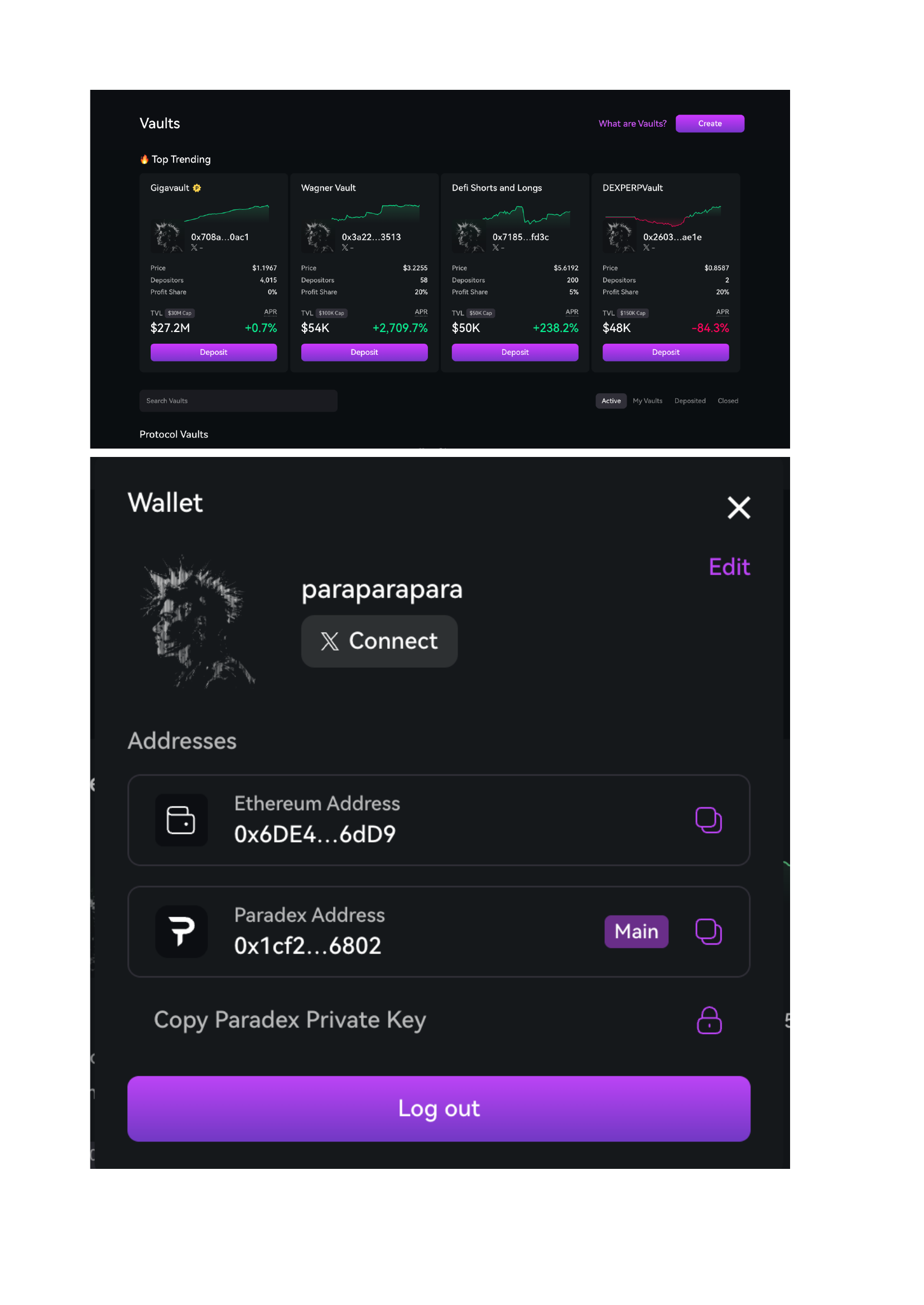

- Vaults

- Note: Core vault APR is lower than platforms like Hyperliquid

- Vault funds (USDC only) are locked up between 1 and 4 days and trade perpetual swaps only

Future Products

- XUSD: Yield-bearing stablecoin

Key Differentiators

Perpetual Options

Retail Price Improvement (RPI)

- Currently in Beta

- "A specialized order type that provides better pricing and execution opportunities for retail traders while protecting market makers from toxic flow. It achieves this through selective order visibility - orders are visible in the UI but hidden from API access"

- Orders only match with non-algorithmic users (only with retail)

- Post-only mandated

- Price must be within current bid-ask (improves price)

- Have lowest execution priority (filled after all non-RPI orders at same price level)

- Interestingly enough, somehow requires order submission via API (not via UI). Unclear on if this feature actually works at all given the conflicting information (see Limitations and Restrictions and Placing an RPI Order in the above link)

Account & Risk Management

Account Hardening

- Guardian keys available for enhanced account security

Risk Management

- They offer unified/portfolio margin to traders, as well as isolated or cross margin

- Liquidation can be performed by a liquidator vault (which users can participate in), although pool is not very large ($57k TVL vs. platform $50M)

Ecosystem

- Wide integration (bridges, wallets, tools, oracles, etc.)

- Backers: GSR, Jump, DCG, and others

Liquidity Statistics

Incentives & XP System

XP Program

- Fuels eligibility for $DIME airdrop (20% at TGE, ongoing issuance)

Referral Program

- 5% of taker fees from referrals

- Referrals receive 5% discount on taker fees

Affiliate Program (application & social reach required)

- Up to 25% extra XP on referred user transactions

- 10% sub-affiliate bonus

Launch Timeline

- Stealth Launch: Closed ETH perps beta on StarkNet

- Sept 2023: Public testnet with trial of deposits, withdrawals, and trading

- Q4 2023: Open Beta with more perps and wider access

- XP Seasons:

- Season 1: Feb 2024 – Jan 2025 (12 months)

- Season 2: Feb – July 2025 (6 months, 4M XP/week)

Special Events

- "Send-it-to-Zero 2.0": 750k XP/week to boost perpetual options trading

- Coverage on guides/blogs/videos for XP farming and $DIME eligibility

Privacy Features

zk-Encrypted Accounts

Paradex uses zero-knowledge encryption for user accounts on its SuperDEX. This hides sensitive details—like positions, entry/exit prices, liquidation thresholds, and real-time P&L—from public view, with the goal of protecting traders from being targeted or hunted by others

Off-Chain Order Book

All orders are matched off-chain, meaning market data like who traded what, when, or how much never hits the on-chain mempool. On-chain activity only records final settlement data, not the granular orderflow. No proof of validity/correctness of matches.

Shielded Pool & Aggregation

Your funds are stored in an encrypted "shielded pool" on StarkNet. Orders are batched before matching, preventing precise inference of order size or timing from particular accounts by observing a single trade However, these are not fully ZK transactions

ZK-SNARK Proofs

Each transaction includes a zero-knowledge proof that verifies the order is valid (within your deposited collateral, respecting limits) without revealing the actual values

MEV Protection

Matched orders are executed via encrypted Dutch auctions, hiding the size and execution details. Settlement happens in bundled batches, which obfuscates exact pre-order timing and volume

Comparison: Paradex vs AlephX

| Aspect | Paradex | AlephX |

|---|---|---|

| Privacy | Hides the users associated with orders. Uses zk-encrypted accounts to make positions, trades and liquidations private (however not deposits and withdrawals) | Privacy design does this and more, including hiding aspects of the actual orders, and allowing full ZK accounts, balances, and transaction records. Planning on using records to provide privacy to all trades/deposits/withdrawals |

| Product Offerings | Primarily a perp and option exchange, so users are able to take on leverage and hedge or speculate on price movements. Users are unable to receive delivery of the underlying asset | Implements a full spot exchange. Users are able to receive actual delivery of the asset they are trading. Perps will be supported, first by third party swaps and then with built-in funding rates/fees, margin and liquidation facilities, etc, but all built on the spot exchange to enable low-cost delivery/settlement of the underlying assets |

| Blockchain Design | Operates on a L2, which requires bridging assets to/from the L1 | Allows for direct trading of the L1 asset |

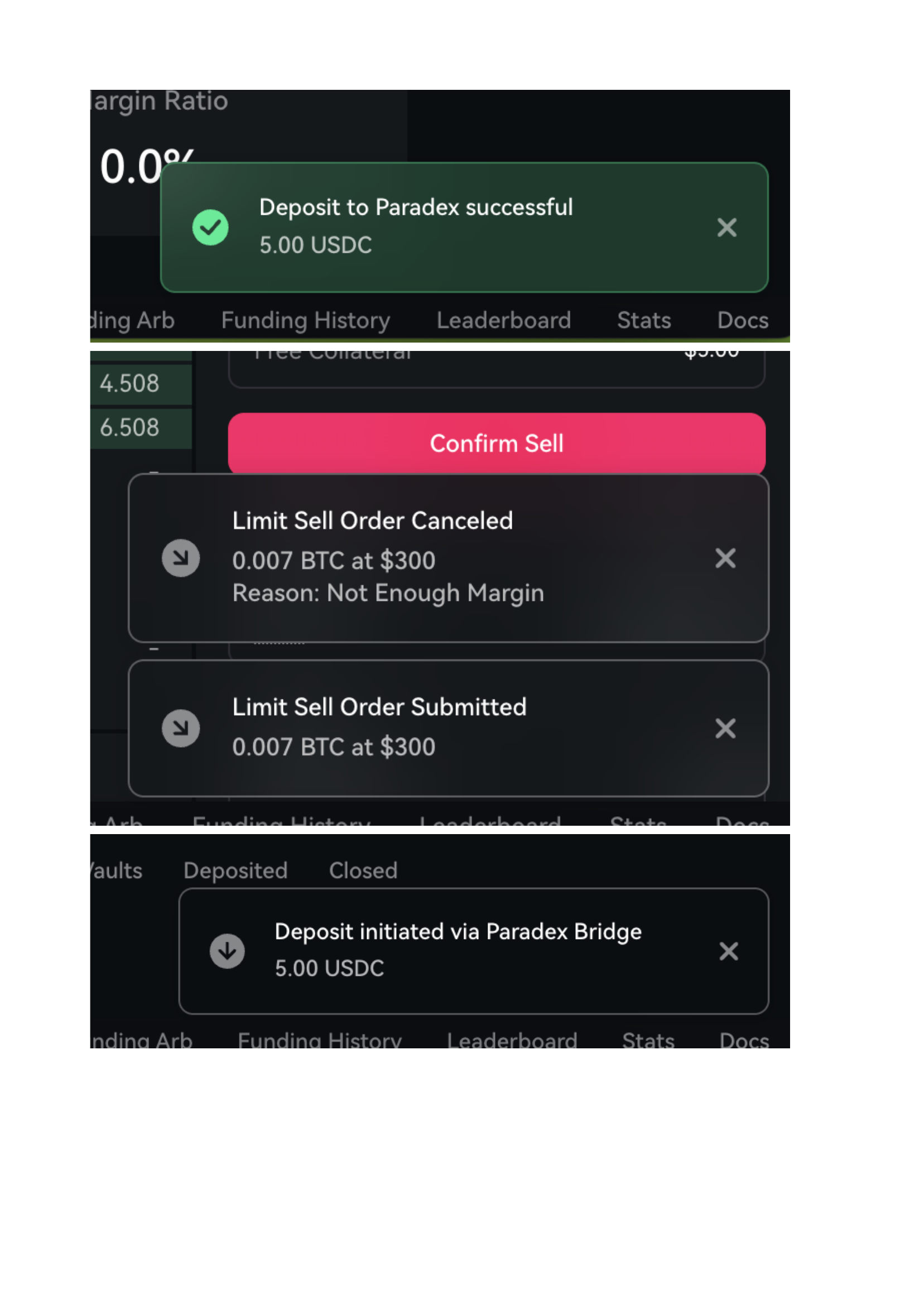

Screenshots